SEE OUR LATEST BLOG POSTS

Securing Your Legacy: A Comprehensive Guide to Trust Registration in South Africa

Securing Your Legacy: A Comprehensive Guide to Trust Registration in South Africa

In an ever-changing world, protecting your assets and providing for your loved ones is more crucial than ever. Trusts are among the most versatile legal tools available for ensuring financial security, managing wealth, and planning your estate. Whether you're safeguarding family assets, planning for future generations, or looking for tax-efficient ways to manage your wealth, a trust offers a robust solution.

This guide explores the essentials of registering a trust in South Africa, the different types of trusts, their benefits, and how they can help you build a legacy that endures.

What is a Trust?

A trust is a legal entity where the founder transfers assets to trustees, who manage these assets on behalf of beneficiaries. This arrangement ensures that your assets are handled responsibly and according to your wishes.

Trusts offer flexibility and control, making them ideal for various purposes, such as:

Protecting assets from creditors.

Providing for minor children or dependents.

Managing charitable donations.

Ensuring seamless wealth transfer across generations.

Example: A family sets up a trust to provide for their children’s education and future needs. This ensures the funds are used solely for their intended purpose and remain protected, regardless of external circumstances.

Types of Trusts in South Africa

South African law recognizes two primary types of trusts, each designed to address specific needs and goals:

1. Inter Vivos Trust (Living Trust)

An inter vivos trust is established during the founder's lifetime. It is commonly used for estate planning, asset protection, and wealth management. This type of trust is ideal for individuals who wish to manage their assets while ensuring future security for their beneficiaries.

Example: After amassing significant wealth through property investments, Sarah creates an inter vivos trust to safeguard her assets against potential business liabilities and ensure her children inherit them seamlessly.

2. Testamentary Trust

A testamentary trust is established in a will and comes into effect after the founder's death. It is often used to provide for minor children or dependents, ensuring their financial needs are met under controlled circumstances.

Example: John’s will specifies that his estate should be placed in a testamentary trust to fund his children’s education until they reach 25. This setup ensures they are supported without unrestricted access to funds during their younger years.

How to Register a Trust

Setting up a trust may seem complex, but following the proper steps ensures a smooth and legally compliant process:

Step 1: Drafting the Trust Deed

The trust deed serves as the cornerstone of the trust. It outlines its purpose, the roles and responsibilities of trustees, and the rights of beneficiaries. A clear and well-drafted trust deed prevents disputes and ensures your intentions are carried out.

Example: A trust deed for the Jackson Family Trust specifies that 60% of trust income must go toward educational expenses for minor beneficiaries, while the remaining 40% is reserved for healthcare needs.

Step 2: Appointing Trustees

Trustees are the custodians of the trust. They manage its assets and ensure compliance with the trust deed. It’s crucial to appoint reliable and capable individuals or institutions as trustees.

Step 3: Registering the Trust

The trust is registered with the Master of the High Court. Required documents include:

A signed trust deed.

Certified copies of trustees' IDs.

An application form for trust registration.

An inventory of trust assets.

Once approved, the Master issues Letters of Authority, enabling trustees to act on behalf of the trust.

Step 4: Tax Registration

Every trust must be registered with SARS as a taxpayer. Trustees are responsible for ensuring the trust complies with tax regulations, including filing annual tax returns.

Example: The trustees of the Greenfield Trust registered the trust with SARS, ensuring compliance with South Africa’s tax laws and avoiding penalties.

The Benefits of Establishing a Trust

Trusts provide a wide range of benefits, making them a popular choice for individuals, families, and businesses. These include:

1. Asset Protection

Trusts shield your assets from creditors, ensuring they remain intact for your beneficiaries.

Example: After facing financial difficulties, Peter's business assets were protected through his inter vivos trust, allowing his family to retain ownership.

2. Tax Efficiency

By transferring assets into a trust, you can reduce your taxable estate, potentially saving on estate duties and other taxes.

3. Continuity and Control

Trusts ensure the seamless transfer of assets without the delays and costs associated with probate. They also allow you to maintain control over how and when assets are distributed.

4. Customization

Trusts can be tailored to suit your specific needs, whether it’s providing for minor children, supporting charitable causes, or managing family wealth.

Example: The Martin Trust was designed to fund scholarships for underprivileged students, creating a lasting legacy that aligns with the founder’s values.

Common Mistakes to Avoid

While trusts are valuable tools, certain mistakes can undermine their effectiveness. Here’s what to watch out for:

1. Vague or Incomplete Trust Deeds

Ambiguities in the trust deed can lead to disputes among trustees and beneficiaries. Always seek professional assistance to ensure clarity and precision.

Example: A vague clause in a trust deed led to a dispute over whether trust funds could be used for travel expenses, delaying critical payments to beneficiaries.

2. Poor Trustee Selection

Appointing unqualified or unreliable trustees can jeopardize the trust’s objectives. Choose individuals or institutions with a track record of integrity and financial management skills.

3. Neglecting Tax Compliance

Failure to register with SARS or file tax returns can result in penalties that erode the trust's value.

Why Work with Legal Experts?

While it’s possible to draft and register a trust independently, the expertise of a legal professional ensures every detail is addressed. A knowledgeable attorney can:

Draft a precise trust deed tailored to your needs.

Ensure compliance with legal and tax regulations.

Advise on the most suitable trust structure for your goals.

Example: When the Williams family wanted to establish a trust to protect their vacation property, their attorney provided guidance on structuring the trust to ensure tax efficiency and legal protection.

Conclusion: Build a Legacy That Endures

A trust is more than a legal arrangement—it’s a commitment to safeguarding your assets, protecting your loved ones, and ensuring your wishes are honored. Whether you’re planning for the future, minimizing estate duties, or supporting a charitable cause, trusts offer unparalleled flexibility and control.

At Neethling & Vosloo Inc., we specialize in trust registration and estate planning. Let us guide you through the process, ensuring your trust is tailored to your unique circumstances and fully compliant with South African law. Contact us today to secure your legacy and provide peace of mind for generations to come.

Contact us today for assistance with all your legal matters

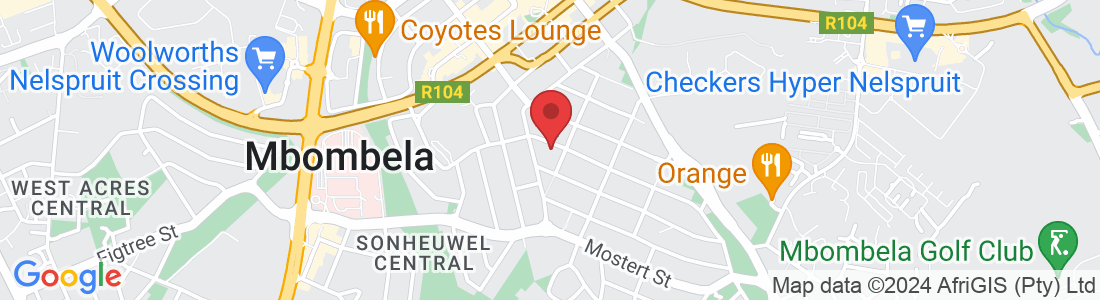

Having trouble locating us? Simply click on the map icon below for directions

Contact Us

Neethling & Vosloo

013 110 0341

Mon - Fri: 8am - 4 pm

Contact Us

Neethling & Vosloo

Call on

013 110 0341