SEE OUR LATEST BLOG POSTS

Navigating Insolvency in South Africa: Your Guide to Sequestration, Debt Relief, and Financial Recovery

Understanding Insolvency Law in South Africa

Insolvency law is an integral part of South Africa’s legal system, providing both individuals and businesses a structured framework for managing unmanageable debt. Whether you're facing mounting personal debt or your business is struggling to meet its financial obligations, insolvency law offers mechanisms for protecting assets, settling debts, and obtaining a fresh start. In this blog, we’ll explore the key components of insolvency law in South Africa, the processes involved, and the potential outcomes for both debtors and creditors.

What is Insolvency?

Insolvency occurs when a person or entity (such as a company) can no longer meet their debt obligations. Legally, insolvency is more than just having debt—it’s when your liabilities exceed your assets and you're unable to pay off what you owe. Insolvency law helps individuals and businesses manage or eliminate their debt under the protection of the court, allowing for an orderly resolution between creditors and debtors.

In South Africa, insolvency law applies to both individuals (natural persons) and businesses (juristic persons), though the processes for each differ slightly.

Individual Insolvency: When an individual cannot pay their debts, they may seek relief through sequestration or other legal remedies like debt review.

Business Insolvency: When a business cannot pay its creditors, it may enter liquidation, business rescue, or other insolvency proceedings to address its financial situation.

Types of Insolvency in South Africa

There are two main types of insolvency proceedings for individuals and businesses in South Africa: voluntary sequestration and compulsory sequestration.

1. Voluntary Sequestration

Voluntary sequestration occurs when the debtor (either an individual or business owner) takes the initiative to declare themselves insolvent. The debtor applies to the court to have their estate (assets and liabilities) sequestrated. This is often seen as a last resort when debts become unmanageable, and the debtor can no longer meet their financial obligations.

Example: David, a small business owner, found himself unable to pay off his creditors due to a series of failed business ventures. Instead of waiting for his creditors to take legal action, David opted to apply for voluntary sequestration. By doing so, his assets were liquidated, and a portion of the proceeds was distributed to his creditors, giving him a fresh financial start.

Voluntary sequestration may offer relief for debtors, but the process can be complex, and not all debts are cleared. Debts secured by assets, such as mortgage bonds, may still need to be paid off, or the asset may be sold to settle the debt.

2. Compulsory Sequestration

Compulsory sequestration occurs when a creditor applies to the court to have a debtor declared insolvent. This typically happens when a creditor can prove that the debtor is unable to pay their debts and that sequestration will benefit the creditors more than other debt recovery options.

Example: After months of chasing unpaid invoices, a supplier of John’s business applied for compulsory sequestration. John had missed several payments, and his creditors believed that sequestration would help them recover some of their losses by forcing the sale of John’s assets.

In both voluntary and compulsory sequestration, the court must be satisfied that sequestration will result in a benefit to creditors. The process is not meant to penalize debtors but to create an orderly system of debt repayment and asset liquidation.

The Sequestration Process

The sequestration process in South Africa involves several steps, all of which are overseen by the courts to ensure fairness for both the debtor and the creditors.

1. Application to Court

The sequestration process begins with an application to the court. In voluntary sequestration, the debtor files the application, while in compulsory sequestration, the creditor does so. In both cases, the applicant must prove to the court that the debtor is insolvent and that sequestration will provide a tangible benefit to the creditors.

Example: To apply for voluntary sequestration, Karen worked with an attorney to compile a list of her assets and debts. Her lawyer presented this information to the court, demonstrating that Karen’s liabilities far exceeded her assets, and that sequestration would allow for a fair distribution of her remaining assets to her creditors.

2. Appointment of a Trustee

Once the court grants the sequestration order, a trustee is appointed to manage the insolvent estate. The trustee’s role is crucial, as they are responsible for gathering and selling the debtor’s assets, paying off creditors according to their priority, and ensuring that the sequestration process is fair and efficient.

Example: After Peter’s compulsory sequestration was granted, a court-appointed trustee took control of Peter’s assets. The trustee began identifying which of Peter’s possessions could be sold to settle his outstanding debts, prioritizing secured creditors (those with assets tied to their loans).

3. Liquidation of Assets

The trustee will sell the debtor’s assets to generate funds for repayment. However, certain assets may be protected under South African law, such as basic household goods necessary for daily living. The trustee will aim to maximize the value of the estate for the benefit of the creditors.

Example: In Sarah’s sequestration case, the trustee liquidated her secondary home and other luxury items but left her primary residence untouched because it was deemed necessary for her and her family’s basic living needs.

4. Distribution to Creditors

Once the assets are liquidated, the proceeds are distributed among the creditors. The distribution follows a specific order, with secured creditors (those whose loans are tied to assets) taking priority over unsecured creditors.

Example: John’s creditors were divided into secured and unsecured groups. The proceeds from selling his assets were first used to settle secured debts, such as his mortgage, before being applied to his remaining debts like credit card bills and personal loans.

5. Rehabilitation

For individual debtors, sequestration does not last forever. Once the sequestration process is complete, the debtor may apply for rehabilitation. Rehabilitation releases the individual from their remaining debts and restores their financial status. This can happen automatically after ten years, or the debtor can apply for early rehabilitation after four years with the court’s approval.

Example: After going through sequestration, Mary applied for early rehabilitation after four years. This allowed her to regain control of her finances and start rebuilding her credit, free from the debt that had previously overwhelmed her.

Consequences of Insolvency

While insolvency can provide a fresh start for debtors, it also comes with significant consequences.

For the Debtor:

Loss of Assets: Insolvency generally leads to the liquidation of personal or business assets, though some essential items may be exempt.

Restrictions on Business Activities: Insolvent individuals cannot serve as directors of companies and may face restrictions on starting new businesses until they are rehabilitated.

Credit Rating Impact: Insolvency will negatively impact the debtor’s credit score, making it difficult to secure loans or credit in the future.

For the Creditors:

Partial Debt Repayment: Creditors may not recover the full amount they are owed, especially if there are limited assets to sell.

Legal Protections: Once sequestration begins, creditors cannot take independent legal action against the debtor and must follow the court's sequestration process.

Alternatives to Insolvency

Before proceeding with sequestration, it’s important to explore alternatives that may help debtors avoid the formal insolvency process.

1. Debt Review

Debt review is a legal process governed by the National Credit Act that allows over-indebted individuals to restructure their debts. A debt counselor helps the debtor negotiate with creditors to lower payments and extend repayment periods, avoiding the need for formal sequestration.

Example: Mark was behind on his car loan and credit card payments, but instead of declaring insolvency, he applied for debt review. This allowed him to renegotiate his debts and lower his monthly payments while keeping his assets intact.

2. Business Rescue

Business rescue is an alternative to liquidation for companies facing financial distress. Under the Companies Act, a business can enter a formal process where it is placed under the supervision of a business rescue practitioner. The practitioner works to restructure the company and develop a rescue plan that satisfies creditors while allowing the business to continue operations.

Example: XYZ Manufacturing was struggling with debt and considered liquidation. Instead, they entered business rescue, and the appointed practitioner helped renegotiate terms with creditors, allowing the company to continue its operations and recover over time.

Why You Need Legal Assistance

Insolvency law is complex and requires careful navigation. Whether you're considering voluntary sequestration, facing compulsory sequestration, or exploring alternatives like debt review or business rescue, it’s essential to seek legal assistance. An experienced attorney can:

Evaluate Your Situation: A lawyer will assess whether sequestration or an alternative route is the best option based on your unique financial circumstances.

Guide You Through the Process: From court applications to working with trustees, legal representation ensures that the sequestration process is managed efficiently and fairly.

Protect Your Rights: An attorney will protect your rights throughout the insolvency process, ensuring that your estate is handled according to the law.

Conclusion

Insolvency law in South Africa provides a structured process for dealing with overwhelming debt, whether you're an individual or a business. Understanding the different forms of sequestration, the process of liquidating assets, and the consequences of insolvency can help you make informed decisions about your financial future. Additionally, alternatives like debt review and business rescue offer solutions that may help you avoid formal insolvency proceedings.

At Neethling & Vosloo Inc., we are dedicated to guiding you through the insolvency process or exploring alternatives that suit your needs. Contact us today for expert legal assistance, whether you're considering sequestration or looking for a way to regain control of your financial situation.

Contact us today for assistance with all your legal matters

Contact Us

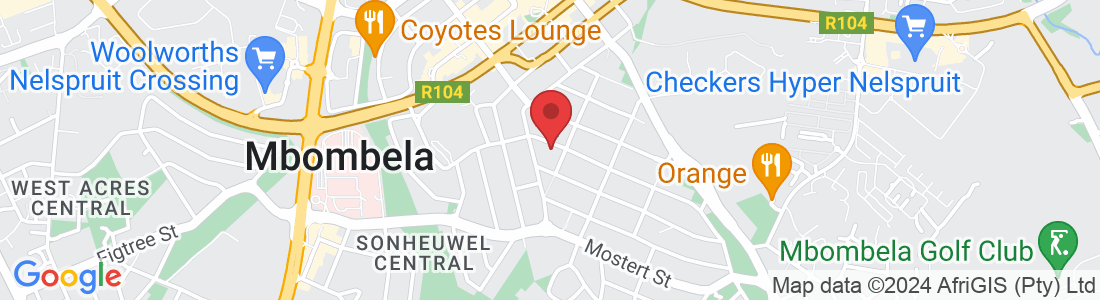

Having trouble locating us? Simply click on the map icon below for directions

Contact Us

Neethling & Vosloo

013 110 0341

Mon - Fri: 8am - 4 pm

Contact Us

Neethling & Vosloo

Call on

013 110 0341